Is Shrimp Feed Production a Viable Business in Vietnam

As shrimp farming expands in Vietnam, feed is playing a more critical role in farm operations. Beyond cost, it directly affects production stability and management risk. This shift has led many farms to evaluate in house shrimp feed production.

Vietnam Shrimp Farming Overview

After the pandemic, Vietnam's shrimp industry has rebounded steadily.

In 2024, shrimp output reached about 1.29 million tons, up 15.3 percent year on year, with exports valued at USD 3.9 to 4.0 billion, accounting for 35 to 40 percent of total seafood exports.

Whiteleg shrimp is the main species farmed in Vietnam, mainly because it grows fast and works well in high density systems.

| Item | Whiteleg Shrimp | Black Tiger Shrimp |

| Farming Area 2024 | 121,000 ha (up 5%) | 628,800 ha (up 1.1%) |

| Output 2024 | 980,000 tons (up 16%) | 284,000 tons (up 3.6%) |

| Five Year Growth | ~13% | ~-1.5% |

| Farming Model | High density, intensive | Traditional, extensive |

| Feed Dependency | Very high, formulated feed | Low to medium, natural feed |

Source based Vietnam's Shrimp Industry

Whiteleg shrimp is the main species farmed in Vietnam due to its short growth cycle and suitability for high density farming.

Local Shrimp Feed Demand

Vietnam's shrimp feed market is one of the most active and profitable segments in global aquafeed. In 2024, feed consumption reached about 1.7 million tons.

Driven by higher stocking density and expanding intensive farming, the market is expected to grow at a 7.4 percent CAGR, reaching around 3.2 million tons by 2033 (Vietnam Shrimp Feed Market Report).

Feed types and product segments

Vietnam's shrimp feed market is mainly divided into starter, grower, and finisher feeds.

Grower feed holds the largest share, as it covers the longest stage of the farming cycle. Starter feed, although used in smaller volumes, has a strong impact on early survival and disease resistance and is increasingly becoming a focus of feed technology development.

| Feed Stage | Product Type | Market Share |

| Starter | Fine pellets / crumbles | 15% |

| Grower | Pellets / extruded feed | 70% |

| Finisher | Pellets | 15% |

Source based Vietnam Shrimp Feed Market

Feed demand differences by farming model

Although Vietnam has a large shrimp farming area, feed demand is mainly driven by intensive systems.

About 200,000 hectares of high-density farms consume over 80 percent of total feed. Traditional low density systems use less feed but show growth potential as farming becomes more controlled.

Feasibility of Local Shrimp Feed Production

Despite challenges from imported raw materials and large competitors, setting up shrimp feed production in Vietnam remains feasible, supported by policy incentives and market growth.

Policy direction and investment incentives

The Vietnamese government views aquaculture as a key development sector and supports the feed industry through relevant laws and regulations.

Feed and agri technology producers benefit from corporate income tax incentives, along with continued support under national aquaculture development programs.

Local advantages

Local ingredients such as rice bran, soybean meal, and cassava make up about 25 to 40 percent of shrimp feed inputs and are readily available in Vietnam.

Lower labor and operating costs support small to mid scale processing, while local production helps reduce transport distance and finished feed logistics costs.

Import tariff reductions

Protein accounts for the largest share of shrimp feed costs, with fishmeal and soy based ingredients making up about 35 to 45 percent and largely imported.

From March 2025, Vietnam cut MFN import tariffs on key aquafeed materials such as soybean meal and corn to 0%, reducing raw material costs and narrowing the gap with commercial feed producers.

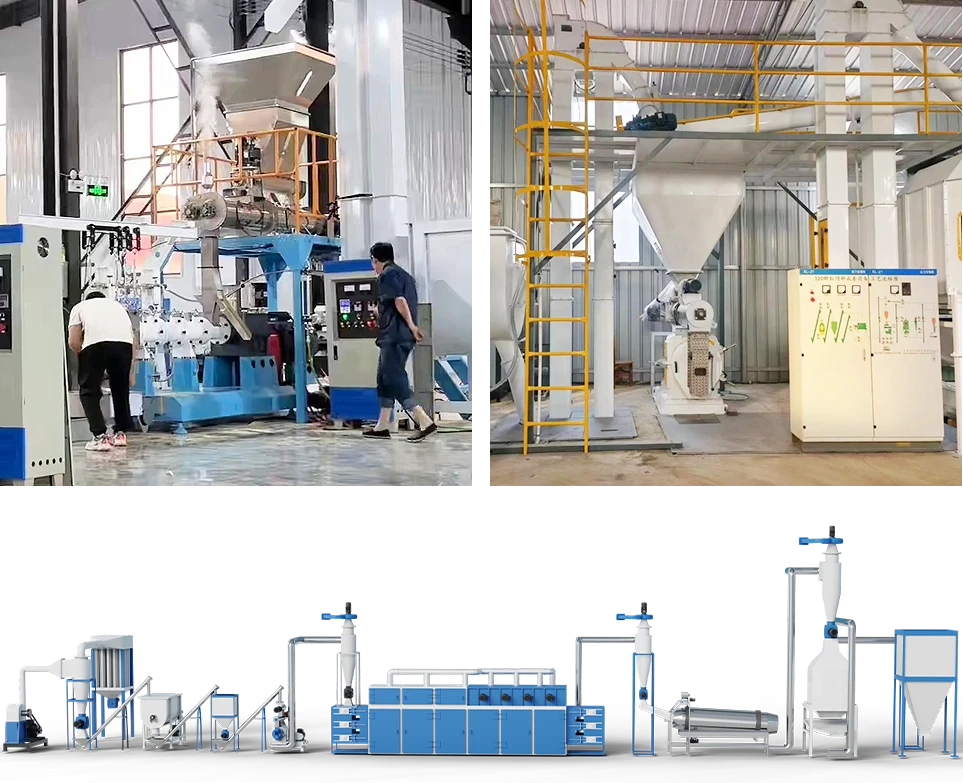

Processing Solutions by Farming Scale

In practice, feed processing methods and equipment requirements vary by farming scale and should be selected based on actual operating conditions.

Commercial scale processing

Large scale production typically requires extrusion or ring die pelletizing to meet shrimp feeding behavior and high water stability requirements.

The process includes raw material intake and cleaning, mixing, fine grinding, conditioning, extrusion, drying, coating, cooling, and automated packaging.

Small scale farm processing

For small scale self-use feed production, flat die pellet mills offer low investment cost and flexible operation, making them a practical option for in house processing.

Benefits of in-house feed production

- Formulas can be adjusted by growth stage

- Lower dependence on commercial feed costs

- Fresh feed through on demand production

- Better control over pellet size and quality

- Clearer ingredient sourcing and improved feed safety

In practice, in house shrimp feed production is feasible when processing equipment is matched to farming scale. Before starting production, it is important to understand relevant policies and regulatory requirements.

We offer a range of professional shrimp feed processing solutions. For equipment selection or production line planning, feel free to leave a message for consultation.

Online Contact

Online Contact Send Message

Send Message

Need Some Help?

Contact us quickly and we will reply you within 24 hours. We will not disclose your information.